Information about being a Church and having a 501(c)3

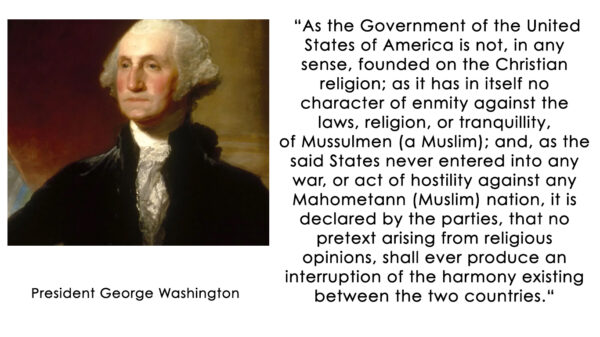

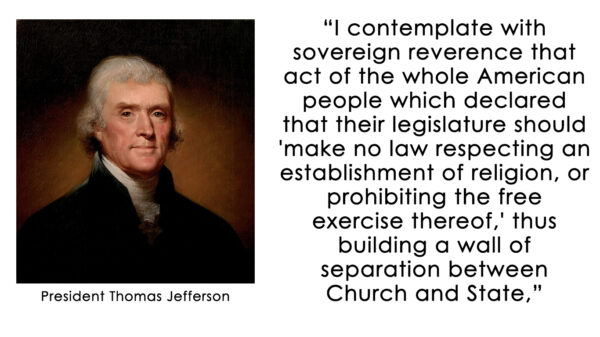

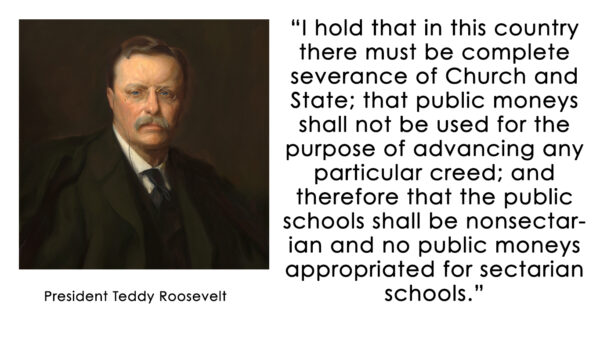

The Separation of Church and State

Oklevueha Native American Church firmly supports the separation of church and state.

501(c)(3) v. Church

Oklevueha Native American Church is considered a church by the IRS. We do not need to apply for a 501(c)(3) exemption, as we meet the qualifications established to define a church. The issue of establishing definitions for a church has big implications. Institutions considered churches are granted tax-exempt status under Section 501(c)(3) of the Tax Code. This is an automatic status, assuming the church passes several tests of authenticity.

Common definitions of the word “church” refer to the religious entity or organization, not just the building itself. The definition becomes more complicated when considering each religious group’s own definition of what constitutes a church.

Certain characteristics are generally attributed to churches. These attributes of a church have been developed by the IRS and by court decisions.

So why would a branch of ONAC require a 501(c)3 status if they aren’t required to?

It’s common for churches to still apply for 501(c)(3) status, even though they aren’t legally required to do so. There are a few reasons for this:

- Having 501(c)(3) status assures your congregation and donors that the church is recognized officially by the IRS as legitimate and tax-exempt, thus guaranteeing their donations and tithes will be tax deductible.

- 501(c)(3) status increases the transparency of the organization, as the church will then be required to file a tax return (called IRS form 990) each year. Those forms are available to the public, again, ensuring donors know that their money is being used in a charitable way. For churches who provide programming like mission work or children’s programs, this transparency can be a great way to let donors know that their contributions are going to a worthy cause.

- Another factor is that 501(c)(3) organizations are given a variety of discounts and benefits. Many companies have programs that discount their services or products for established nonprofits like churches but require 501c3 status to ensure the legitimacy of the organization. The US Postal Service also offers discounted rates for mailing and postage for established 501c3 organizations.

- Some states provide additional tax exemptions for established 501(c)(3) organizations like exemption from state sales tax or state employment tax. These tax exemptions can help churches spend more of their funding on their religious services and programs, rather than on taxes.

Churches who operate under a 501(c)3 status are required to file tax documents to the IRS. Filing tax documents each year in no way nullifies a church’s tax-exempt status, but the IRS requires filing each year.

We wish to point out that by virtue of the fact that you are branch of Oklevueha Native American Church, you are considered a “real” church by the United States government and the IRS. However, should you choose to become a non-profit organization, you need to understand that the government will have more say in what you do, how you practice, and how you pay your taxes.